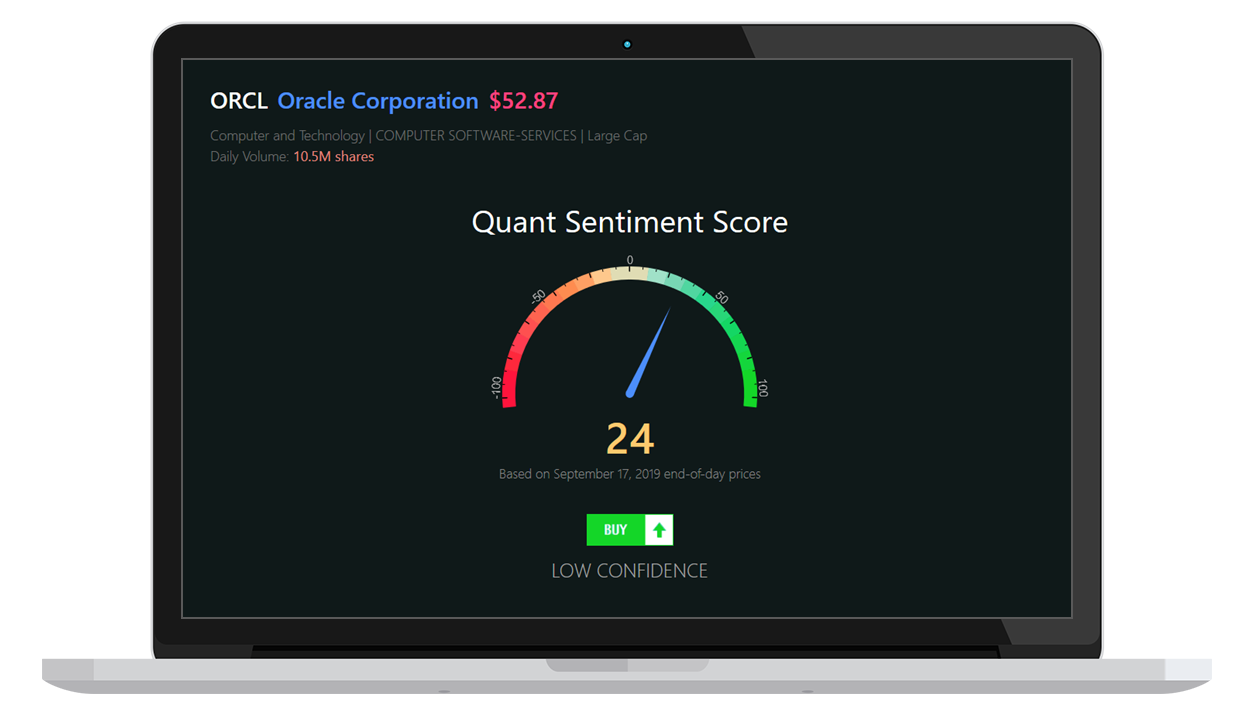

The Quant Sentiment Score is calculated from the combination of all action signals and cycle indicators for the specific stock on the specific day.

Ranging from -100 to +100, the Score takes into account all BUY and SELL action signals and BULLISH/BEARISH cycle indicators, weighted by the ratings of the Models.

Based on the Combined Score, the system ranks stocks to BUYs, SELLs, or HOLDs, with confidence ranging from VERY HIGH to VERY LOW.

Quant Scores are re-calculated on a daily basis, after U.S. stock market closes.

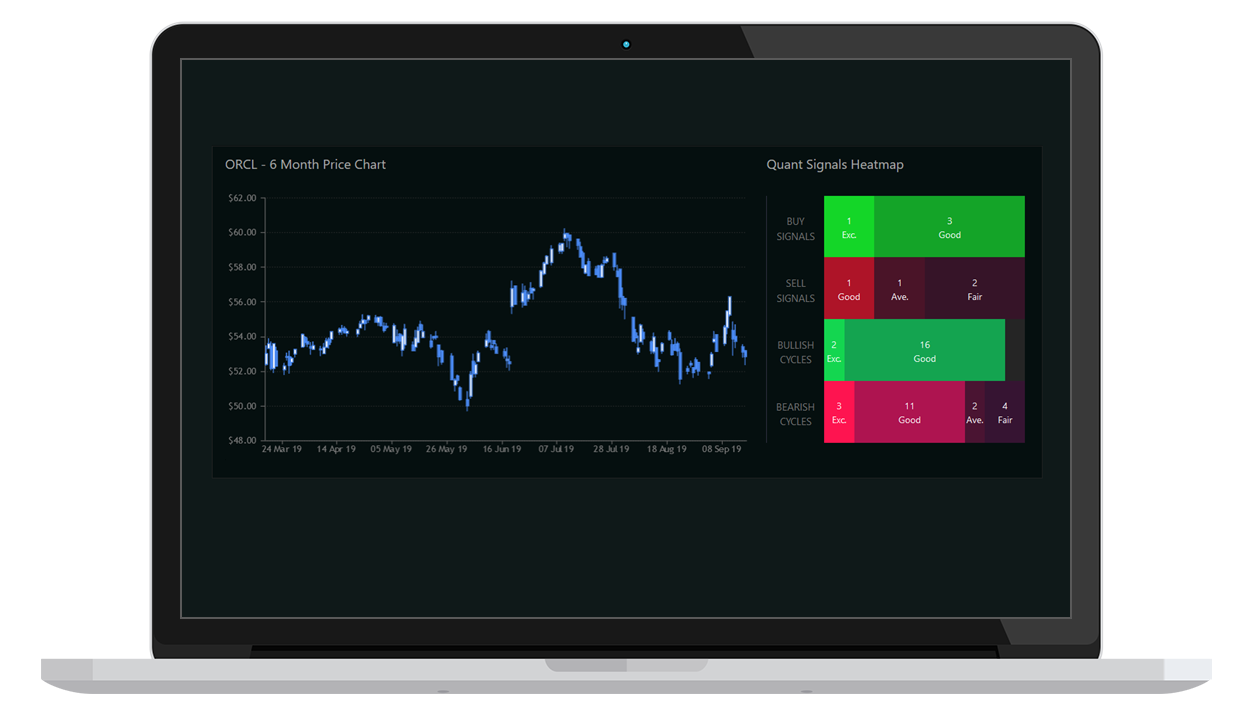

Signals Heatmap visualizes BUY/SELL signals, BULLISH/BEARISH cycle indicators, and their ratings on the stock for a given date. Ratings include:

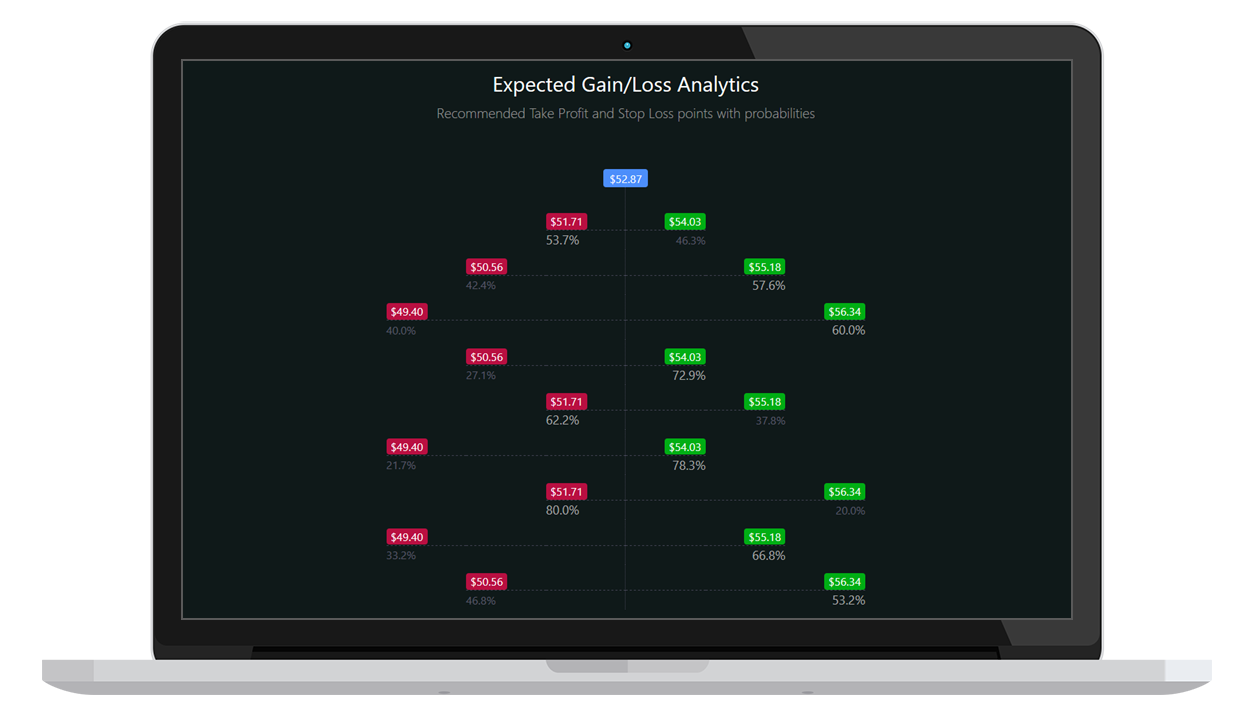

With every BUY or SELL signal, QuantumStocks provides probabilistic analysis on potential gain and loss for different exit points.

Probabilities are calculated from thousands of backtest results where machine intelligence tests and learns patterns based on dozens of simulated exit strategies.

Different levels of potential exits are calculated based on stock price volatility and last 20 day ATR value (Average True Range)

Each row in the tree represents a pair of upside/downside points. For example, the first line tells that there is 62.2% chance that the stock price will reach $126.99 BEFORE reaching $116.41.

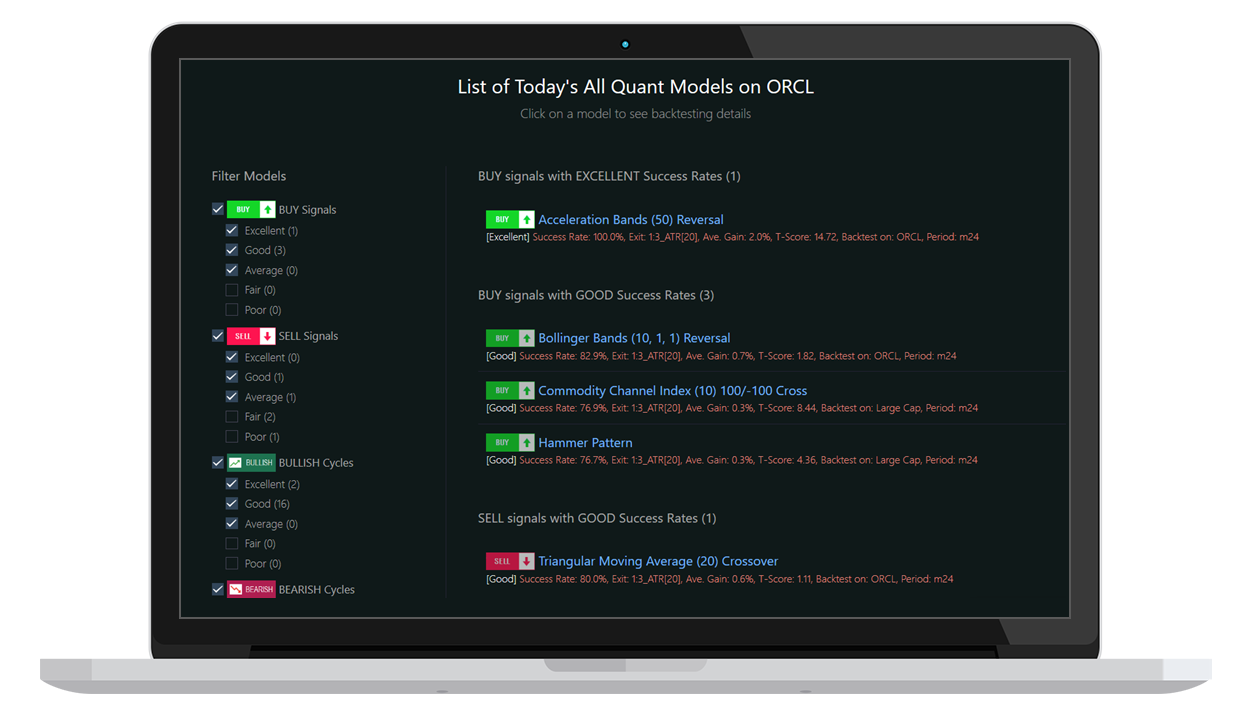

The list shows all Quant Models that have an action signal or trend-cycle indicator on the stock for today.

Models are grouped first by their signals/cycles, then by their ratings.

Along with the name and rating, the list shows results of the best back-test for Model/Stock pair, including backtest period, Exit Strategy, Success Rate, Average Gain and T-Score.

By clicking on the list item, you can delve deeper into Model details by opening Model Analytics view.

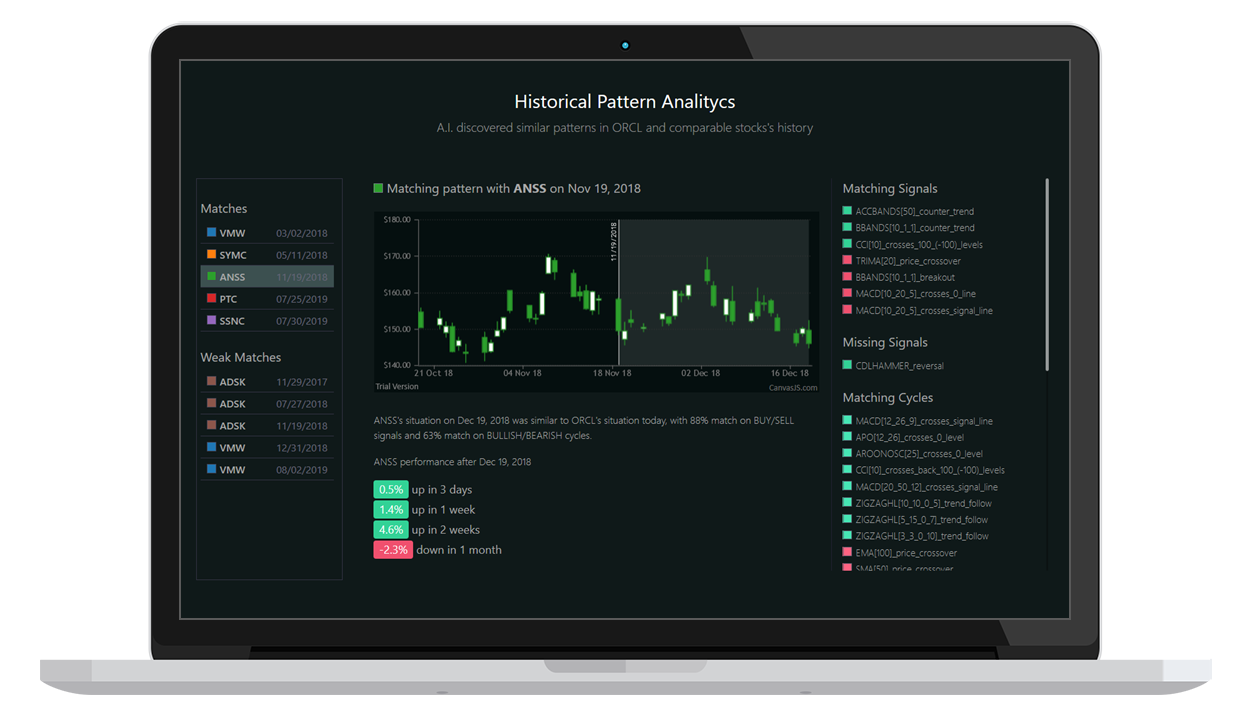

Another unique feature from Arizet's A.I. engine available to "Plus" and "Pro" users is discovering similar patterns in history to better understand underlying risks and opportunities.

Similar pattern and subsequent 3 day, 1 week, 2 week and 1 month period stock price analytics allows you to further minimize risks and focus only on best opportunities.

By analyzing matching and missing signals and cycles, you can better understand how the patterns evolved over time and how different combinations of signals/cycles drive the stock prices.

There are four possible outputs from each Model for each stock: BUY signal, SELL signal, BULLISH cycle, BEARISH cycle.

BUY and SELL signals are calls for action based on today's closing price. BULLISH and BEARISH indicate that the stock is in a bullish or bearish cycle, though no action is recommended for today. Bullish cycle is either Up-Trend or Oversold situation, while Bearish cycle means Down-Trend or Overbought state.

Along with BUY and SELL action signals, Arizet provides TAKE PROFIT and STOP LOSS recommended exit points based on historical trading data and probabilities.

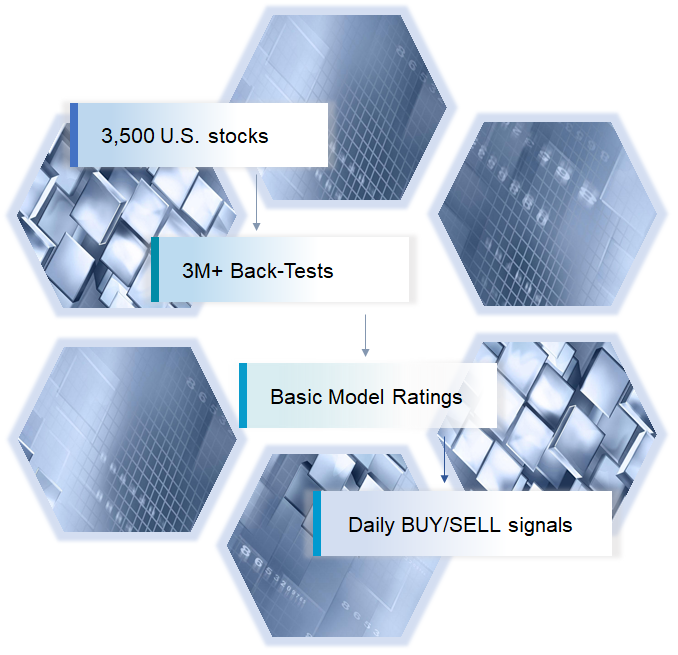

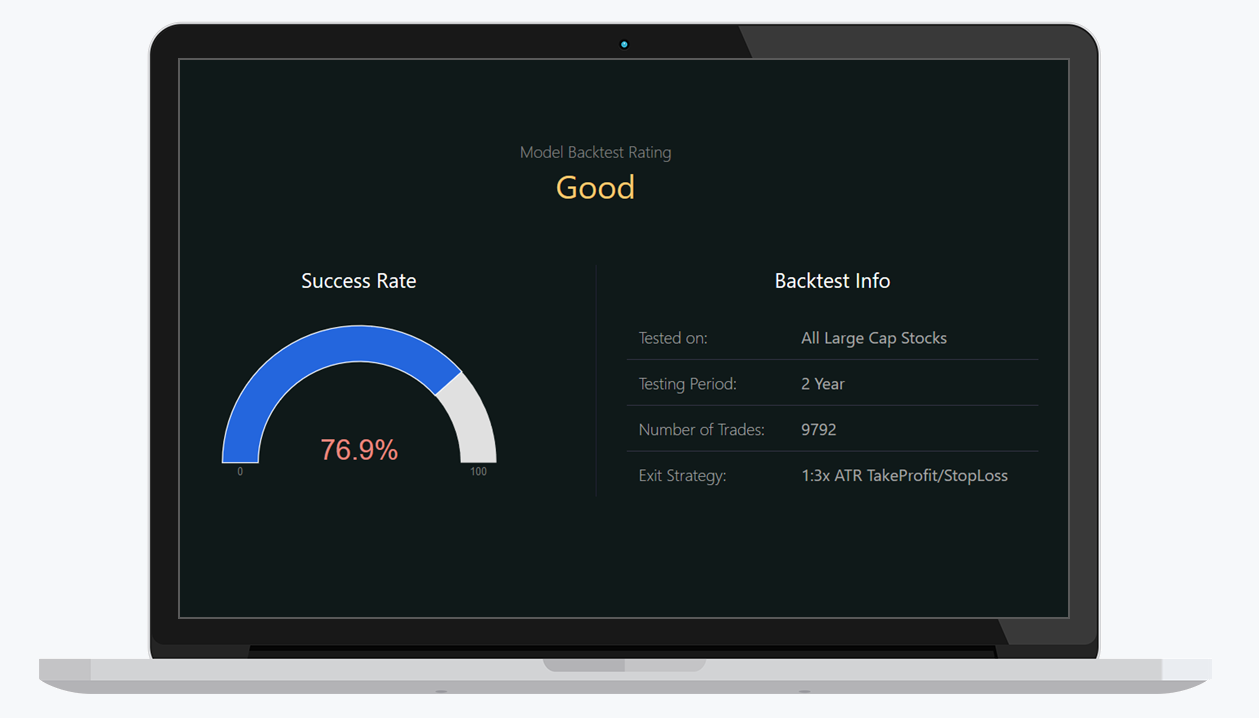

Quant Models are constantly tested and analyzed on each stock separately, as well as on sectors, market cap groups and the whole universe.

For each model, thousands of different exit strategies, testing periods and model parameters are tested simultaneously to identify best combinations that work and to filter out the ones that do not work.

Models then are rated based on their historical predictive power (Success Rate during back-test)

Arizet's A.I. is not a "black-box" strategy. It provides a comprehensive visual features to analyze Models past performance and assess their quality.

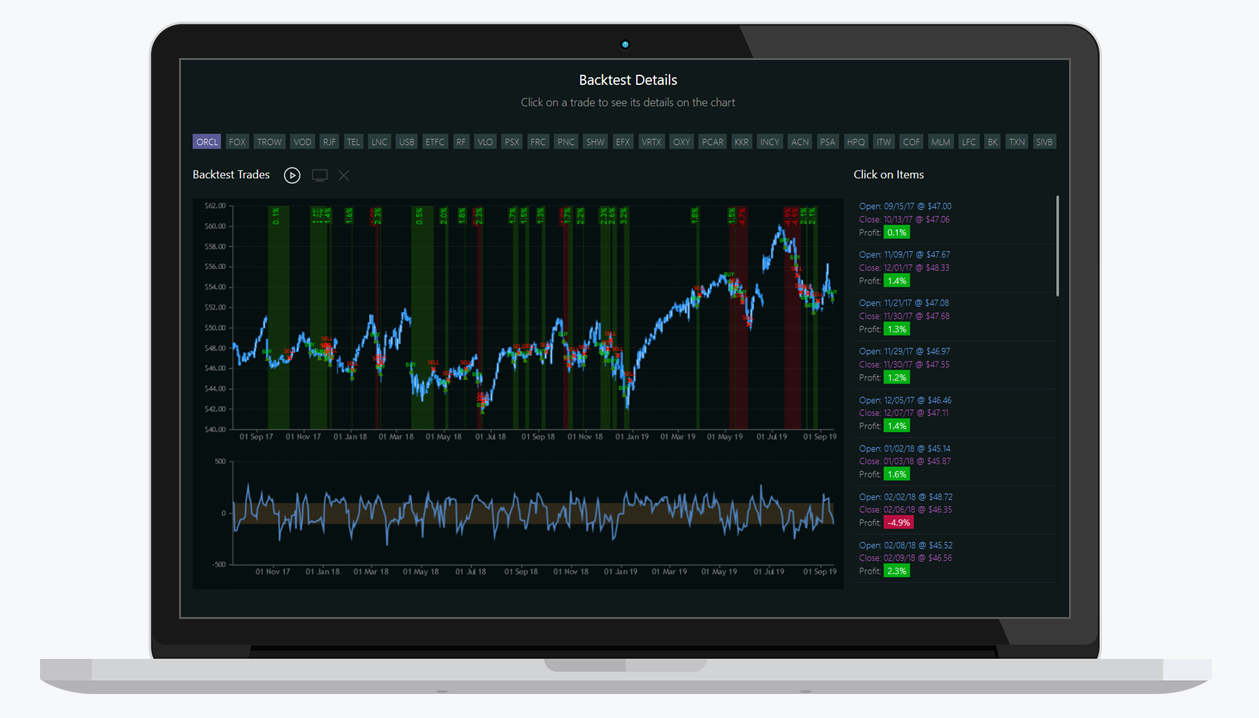

Backtest Details and Charting view shows stock price chart and historical trades made by the Model. You can zoom in/out, scroll and animate the chart, click on a specific trade and analyze it in every detail.

Statistics section shows gain/loss distribution over the testing period, as well as statistical outputs from the back-test to allow you better assess the effectiveness of the Model.

Some important data points you might want to analyze are: